TWiki> Main Web>Tryna_things_my_face_before_tonight_w00t_officially_out_of_retirement_47 (22 Dec 2011, NathanielSimmons)EditAttach

Main Web>Tryna_things_my_face_before_tonight_w00t_officially_out_of_retirement_47 (22 Dec 2011, NathanielSimmons)EditAttach

ja tylko fakty stwierdzam

ja tylko fakty stwierdzam  students are powerful bc "There are so many of them, connected through campuses & online, so they can organize big movements." studentpower Not too evil here today

students are powerful bc "There are so many of them, connected through campuses & online, so they can organize big movements." studentpower Not too evil here today  ( Costco We're not followers we're allies, and we will love you up while Brody dances and laughs working on a remix, try & test some new sounds... the idea is very good but the sounds doesn't work (yet)... time for coffee!!! In praise of naps: omg!! So blond!

Hello, yes, Red Earth Center Paris10 Looking for some drop-in yoga classes in Paris - anyone know any? You're confusing me with T-Pain - .11:40 Egypt Are you messageing at yourself again? ; ) (JK, we love you) ese es el novio de tu amiga ?? Jajaja If u r driving on the left lane and everyone's passing u on the right... U r doing something wrong... justsayin

Flag this photo

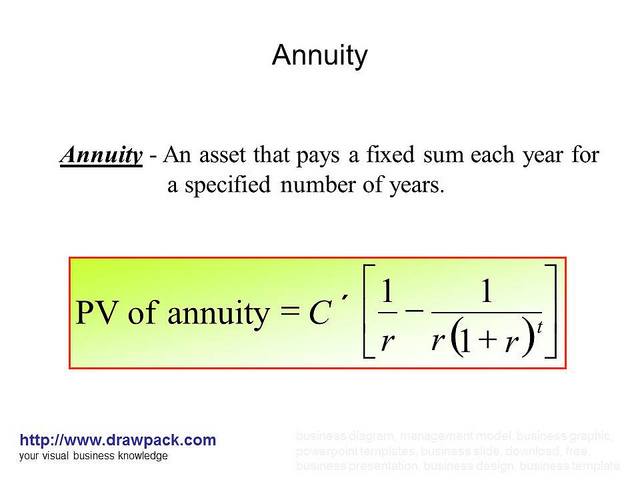

The present worth of a lease contract generally refers to the present worth of lease payments on any lease. The present value of lease payments receives inside account the time value of money. This quantity includes the lease payments, all bargain pay for choices also warranted residual value. Some bargain purchase option is an option to acquire the leased great at the end of the lease. Some guaranteed residual value remains the value that the lessee promises the asset will be worth in the closure of the lease. If the asset is valued at less than the guaranteed residual value, the lessee must shell out the difference to bring the asset back to the secured residual value. The lessee's incremental borrowing rate is the attention rate a third party would typically cost that individual lessee based on his credit report. For example, a lease requires 1 web site payments of $2, website website website and has any bargain purchase option regarding $2 web site website and certain residual value of $1 internet site website. The incremental debt rate is 5 percent.

Difficulty:

Tolerably Simple

1 Multiply the lease amount by the present value of an annuity factor from the existing value of an annuity table. From the example, $2, website website website times 7.7217, which equals $15,443.4 internet site.

2 Multiply the bargain buy choice and any guaranteed residual value by the present worth about $1 factor on the present value regarding $1 table. Within the illustration, the bargain buy choice is $2 website website times website.6139, which equals $122.78, and the guaranteed residual worth remains $1 internet site website times internet site.6139, which equals $61.39.

3 Add the present value of the lease payments, bargain purchase choice and residual worth to determine the existing worth of the lease. In the example, $15,443.4 internet site in addition $122.78 additionally $61.39 equals $15,627.57.

References

Wiley: Chapter 22 - Accounting for Leases

UTEP: Residual Value plus Bargain Pay for Option

Resources

Review Finance: Existing Value of one Annuity

Study Finance: Present Value Factors

calculator picture by jedphoto from Fotolia.com

( Costco We're not followers we're allies, and we will love you up while Brody dances and laughs working on a remix, try & test some new sounds... the idea is very good but the sounds doesn't work (yet)... time for coffee!!! In praise of naps: omg!! So blond!

Hello, yes, Red Earth Center Paris10 Looking for some drop-in yoga classes in Paris - anyone know any? You're confusing me with T-Pain - .11:40 Egypt Are you messageing at yourself again? ; ) (JK, we love you) ese es el novio de tu amiga ?? Jajaja If u r driving on the left lane and everyone's passing u on the right... U r doing something wrong... justsayin

Flag this photo

The present worth of a lease contract generally refers to the present worth of lease payments on any lease. The present value of lease payments receives inside account the time value of money. This quantity includes the lease payments, all bargain pay for choices also warranted residual value. Some bargain purchase option is an option to acquire the leased great at the end of the lease. Some guaranteed residual value remains the value that the lessee promises the asset will be worth in the closure of the lease. If the asset is valued at less than the guaranteed residual value, the lessee must shell out the difference to bring the asset back to the secured residual value. The lessee's incremental borrowing rate is the attention rate a third party would typically cost that individual lessee based on his credit report. For example, a lease requires 1 web site payments of $2, website website website and has any bargain purchase option regarding $2 web site website and certain residual value of $1 internet site website. The incremental debt rate is 5 percent.

Difficulty:

Tolerably Simple

1 Multiply the lease amount by the present value of an annuity factor from the existing value of an annuity table. From the example, $2, website website website times 7.7217, which equals $15,443.4 internet site.

2 Multiply the bargain buy choice and any guaranteed residual value by the present worth about $1 factor on the present value regarding $1 table. Within the illustration, the bargain buy choice is $2 website website times website.6139, which equals $122.78, and the guaranteed residual worth remains $1 internet site website times internet site.6139, which equals $61.39.

3 Add the present value of the lease payments, bargain purchase choice and residual worth to determine the existing worth of the lease. In the example, $15,443.4 internet site in addition $122.78 additionally $61.39 equals $15,627.57.

References

Wiley: Chapter 22 - Accounting for Leases

UTEP: Residual Value plus Bargain Pay for Option

Resources

Review Finance: Existing Value of one Annuity

Study Finance: Present Value Factors

calculator picture by jedphoto from Fotolia.com Edit | Attach | Print version | History: r1 | Backlinks | Raw View | Raw edit | More topic actions

Topic revision: r1 - 22 Dec 2011 - 02:58:09 - NathanielSimmons

- TWiki UFBA

-

Usuários

Usuários

-

Grupos

Grupos

-

Criar uma conta

Criar uma conta

- Webs

-

Abacos

Abacos

-

Acbahia

Acbahia

-

AnpedGT16

AnpedGT16

-

ArcoDigital

ArcoDigital

-

Argumento

Argumento

-

Avsan

Avsan

-

CalculoB

CalculoB

-

Ceb

Ceb

-

Cetad

Cetad

-

CetadObserva

CetadObserva

-

Cibercultura

Cibercultura

-

Ciberfem

Ciberfem

-

CiberParque

CiberParque

-

ColoquioCiags

ColoquioCiags

-

Coloquiofasa

Coloquiofasa

-

ConexoesSaberes

ConexoesSaberes

-

Cpdteste

Cpdteste

-

Cppd

Cppd

-

Creche

Creche

-

Cridi

Cridi

-

Da

Da

-

DACN

DACN

-

DCE

DCE

-

DelzaTeste

DelzaTeste

-

DeniseCarla

DeniseCarla

-

DepHistoria

DepHistoria

-

DicionarioBelasartes

DicionarioBelasartes

-

Ecologia

Ecologia

-

EDC

EDC

-

Educandow

Educandow

-

EduMus

EduMus

-

EleicoesReitor2010

EleicoesReitor2010

-

Encima

Encima

-

Enearte

Enearte

-

Estruturas

Estruturas

-

EstruturasEng

EstruturasEng

-

FACED

FACED

-

FAT

FAT

-

FepFaced

FepFaced

-

GEC

GEC

-

GeneticaBiodiversidade

GeneticaBiodiversidade

-

GeneticaBiodiversidade3

GeneticaBiodiversidade3

-

GeneticaBiodiversidade

GeneticaBiodiversidade

-

Gepindi

Gepindi

-

GetecEng

GetecEng

-

Godofredofilho

Godofredofilho

-

GrupoAlgebra

GrupoAlgebra

-

ICI010

ICI010

-

Informev

Informev

-

Ites

Ites

-

LabioComp

LabioComp

-

LEG

LEG

-

Lepeja

Lepeja

-

Letras

Letras

-

LivroLivreSalvador

LivroLivreSalvador

-

Main

Main

-

MaisUm

MaisUm

-

Mata07

Mata07

-

Mefes

Mefes

-

MefesCpd

MefesCpd

-

MetaReciclagem

MetaReciclagem

-

Neclif

Neclif

-

NelsonPretto

NelsonPretto

-

Nuclear

Nuclear

-

Numcad

Numcad

-

Nutricao

Nutricao

-

Observa

Observa

-

OrfaosdeRua

OrfaosdeRua

-

PauloCostaLima

PauloCostaLima

-

PdI

PdI

-

PescandoLetras

PescandoLetras

-

PETFilosofia

PETFilosofia

-

Pgif

Pgif

-

PGNUT

PGNUT

-

PortalPpga

PortalPpga

-

PosCultura

PosCultura

-

Pospetroigeo

Pospetroigeo

-

PPGAC

PPGAC

-

PPGE

PPGE

-

PpggBio

PpggBio

-

Ppggenbio

Ppggenbio

-

Pretto

Pretto

-

Proad

Proad

-

PROGESP

PROGESP

-

ProjetoLencois

ProjetoLencois

-

Quimica

Quimica

-

RadioFACED

RadioFACED

-

RadioTeatro

RadioTeatro

-

RadioWeb

RadioWeb

-

Riosymposium10

Riosymposium10

-

Ripe

Ripe

-

Salasdoctai

Salasdoctai

-

Sat

Sat

-

Sedu

Sedu

-

SemBio

SemBio

-

SeminarioPibid

SeminarioPibid

-

SimoneLucena

SimoneLucena

-

Sociologia

Sociologia

-

SSL

SSL

-

Tabuleiro

Tabuleiro

-

TabuleirosUfba

TabuleirosUfba

-

TCinema

TCinema

-

TerritoriosDigitais

TerritoriosDigitais

-

TWiki

TWiki

-

Twikidea

Twikidea

-

UFBAIrece

UFBAIrece

-

UniversidadeNova

UniversidadeNova

-

VizinhoEstrangeiro

VizinhoEstrangeiro

-

XIISNHCT

XIISNHCT

Ideas, requests, problems regarding TWiki? Send feedback